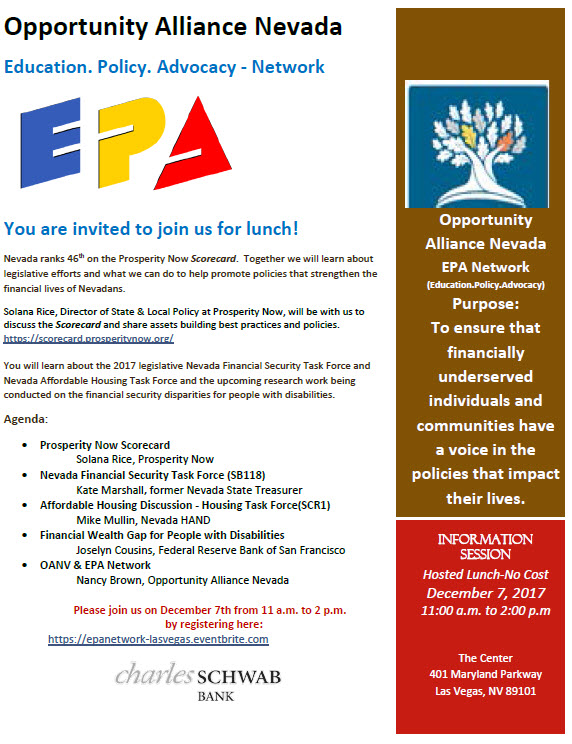

Thank you to Prosperity Now for this 2017 award…

The award for most advocacy actions taken in 2017 goes to… Opportunity Alliance Nevada! Learn more about the work they do to help low-income Nevadans thrive by following @NVOppAll & visiting https://t.co/DFEs4jKBfO. Thanks for all you do!

— Prosperity Now (@prosperitynow) December 21, 2017