Click Here to Download Flyer .pdf

Licensed by Nationally Recognized Central New Mexico Community College’s CNM Ingenuity, Inc. Accredited Program

2019 Training Dates

Reno: Check Back for 2020 Dates!

Las Vegas: Oct 7-9 & Nov 4-6 – Click Here

2019 Training Cost: $699 per person

NOTE: Full scholarships are available for applicants serving low to moderate income clients

Contact Lynne Keller to request a scholarship application: Lynne@opportunityalliancenv.org

Seating Limited! Register Today!

Testimonial Video … Click “Play” Button

Training Description

Accredited by the Center for Credentialing Education, 40-hour training (two 2 ½ day sessions) incorporates research of behavioral finance and knowledge of low income client populations. It is a dynamic model of interactive coaching training combined with strong financial content. Participants are expected to complete all of the two-part, 5-day training, after which they will receive a certificate for the 40 hours. If an individual wishes to become a board certified coach through the CCE, s/he can use the 40 hours toward the required training. Details for certification are available upon request.

Accredited by the Center for Credentialing Education, 40-hour training (two 2 ½ day sessions) incorporates research of behavioral finance and knowledge of low income client populations. It is a dynamic model of interactive coaching training combined with strong financial content. Participants are expected to complete all of the two-part, 5-day training, after which they will receive a certificate for the 40 hours. If an individual wishes to become a board certified coach through the CCE, s/he can use the 40 hours toward the required training. Details for certification are available upon request.

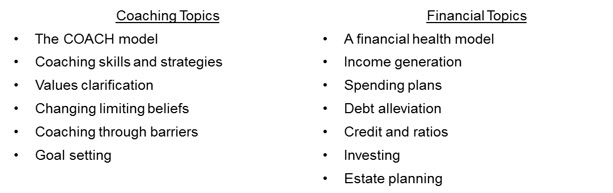

Coaching is an increasingly more effective way to work with individuals and families in building financial capability. By building a relationship of trust and understanding, coaches are able to move their clients from financial literacy to behavioral change. Topics covered include:

What Is Financial Coaching?

Accreditation

Our 60-hour training (40 hours — two 2 ½ day sessions plus 20 hours of practicum) Financial Coach Training program uses the standardized curriculum created by the Central New Mexico (CNM)’s CNM Ingenuity, Inc. This training is accredited by the Center for Credentialing Education.

What this means for participants of our training program:

After completing our two-part, 5-day training, participants will receive a certificate for the 40 hours. If an individual wishes to become a board certified coach through the CCE, s/he can use the 40 hours toward the required training as we are listed as an approved training provider for the CCE.

Training requirements for certification are provided on the site and number of hours required are dependent on level of education, training hours, and hours of professional coaching.

Overview

Financial coaching is an application of techniques emerging from research in positive psychology. Coaching methods have been applied in areas such as physical and mental healthcare, management and career planning. A key assumption in financial coaching is that a client is creative and resourceful, yet may need assistance in tapping into those positive attributes. Typically, a coach works with a client to zero in on a behavior or behaviors to improve upon. The focus is on performance gains driven by the goals of the client. Unlike a counselor who helps solve problems, the coach provides a structure for clients to develop their own solutions. In the long run, coaching helps people develop skills and behaviors they can improve upon independently.

Financial coaching is an application of techniques emerging from research in positive psychology. Coaching methods have been applied in areas such as physical and mental healthcare, management and career planning. A key assumption in financial coaching is that a client is creative and resourceful, yet may need assistance in tapping into those positive attributes. Typically, a coach works with a client to zero in on a behavior or behaviors to improve upon. The focus is on performance gains driven by the goals of the client. Unlike a counselor who helps solve problems, the coach provides a structure for clients to develop their own solutions. In the long run, coaching helps people develop skills and behaviors they can improve upon independently.

Financial coaching is simply an application of coaching techniques designed to develop a client’s capability to manage their own finances and sustain economic security in accordance with their self-defined goals. The coach helps the client set goals, define the short- and intermediate-term steps to achieve the goals, form specific intentions to implement steps toward those goals and then monitors the client and provides feedback on performance. Unlike a counseling model, the coach does not have to be an expert on financial issues, but does need to have skills in active listening, motivational interviewing and performance monitoring.

Coaches help clients in several ways. Initially, the coach helps the client focus on financial management. Rather than diagnose problems and revisit past mistakes, the coach guides the client to articulate their goals for the future. This assists the client in becoming more future- oriented and developing a step-by-step plan like paying down debt or saving for a longer-term goal. By providing a structure, the coach can encourage clients to practice financial behaviors, offering feedback so clients can improve their capabilities on their own. This helps increase self-confidence and reduces stress related to financial management.

Coaches help clients in several ways. Initially, the coach helps the client focus on financial management. Rather than diagnose problems and revisit past mistakes, the coach guides the client to articulate their goals for the future. This assists the client in becoming more future- oriented and developing a step-by-step plan like paying down debt or saving for a longer-term goal. By providing a structure, the coach can encourage clients to practice financial behaviors, offering feedback so clients can improve their capabilities on their own. This helps increase self-confidence and reduces stress related to financial management.

Coaches help clients overcome their own behavioral failings, especially self-control problems (inability to control or defer spending), procrastination (taking on un-pleasant tasks like financial planning that are easily put off), and focusing attention (setting up a process to take care of regular financial maintenance tasks like paying bills).

Through coaching, clients are able to acquire the fundamental skills that enable them to achieve long-term financial security and mobility by building and growing assets such as emergency savings, building credit, debt reduction and retirement savings. With these newly ad- opted techniques, clients are positioned to be in better control of their economic situation and less likely to re- quire financial support later.

Through coaching, clients are able to acquire the fundamental skills that enable them to achieve long-term financial security and mobility by building and growing assets such as emergency savings, building credit, debt reduction and retirement savings. With these newly ad- opted techniques, clients are positioned to be in better control of their economic situation and less likely to re- quire financial support later.

================

Click “play button” below to watch video of cool activity from training…