ARCHIVE of Featured Community Partners

- Boys and Girls Club of Truckee Meadows

- Nevada Business Opportunity Fund

- Northern Nevada Hopes

- Reno Housing Authority (RHA)

- Truckee Meadows Community College

- Unite Nevada

- University of Nevada, Las Vegas

- University of Nevada, Reno

- United Way of Northern Nevada and the Sierra

Opportunity Alliance Nevada is working with Unite Nevada, the Nevada Network for Unite Us platform, to create a network of Nevada community-based organization social service and health care providers to support Nevadans and their communities streamline their referral processes, address Nevadans’ social needs, and improve health across Nevadan communities.

Unite Us offers a technology-based, coordinated care network that enables health and social service care providers across communities to connect with one another for seamless referral and service delivery. The Unite Us Platform is available at no cost to community service providers in Nevada, thanks to support from Health Plan of Nevada: A United Healthcare Company, who are already using the Unite Us Platform to connect patients with community-based organizations. The Unite Nevada network offers a coordinated care network of health and social service providers to address people’s social needs and improve health across communities. Most importantly, the Unite Us Platform helps communities better connect health and social care, which helps address health equity issues.

To join the Unite Nevada network, contact Nathan G. Strong, OANV Executive Director, to be invited to an upcoming information and strategy session to learn more about the Unite Us platform and see a demo of it in action. You can contact Nate via email at Nate@OpportunityAllianceNV.org to request your organization be added to the Unite Us network invite list.

To learn more about Unite Us and the work they’re doing in communities across the country, visit www.uniteus.com.

Boys and Girls Club of Truckee Meadows

How does the Boys and Girls Club of Truckee Meadows partner with Opportunity Alliance Nevada?

In addition to the Teens Services Director sitting on the board and hosting Youth Committee Meetings, the Boys & Girls Club utilizes and promotes financial literacy as well as the message that all youth can go to college by helping encourage our members and parents to participate in Kickstart, a college savings program, and The Guinn Millennium Scholarship and Nevada Promise Scholarship for our Seniors in High School.

What financial literacy programs do the Boys and Girls Club of Truckee Meadows offer for their club members and families?

At the Boys & Girls Club we offer Money Matters:

- Make it Count, a BGCA program sponsored by Charles Schwab

- My Path: A hands-on savings experience for our Jr Staff where they are provided with a saving account courtesy of United Federal Credit Union, create and work towards a savings goal, and participate in online and peer activities to learn more about managing personal finances.

- Bite of Reality, sponsored by Greater Nevada Credit Union: A simulation in which Teen members get the opportunity to budget everyday finances after being assigned a career, salary and a family.

How does youth financial literacy fit into the Boys and Girls Club of Truckee Meadows mission?

Our mission is to enable all young people, especially those who need us most, to reach their full potential as productive, caring, responsible citizens. In order to be productive and responsible citizens, financial literacy is needed to help our youth refrain from accumulating debt and successfully simulate into the workforce, our youth need to be prepared to spend and save responsibly.

Is there anything else you would like to share with us?

The Boys & Girls Club offers affordable childcare for children ages 6-18. Our priority is to provide a safe and supportive environment for kids to have fun. We also expose members to new opportunities and expectations and recognize the accomplishments they make no matter how big or small. We do this by providing enrichment in 5 program areas: Character and Leadership Development, Health and Life Skills, Education and Career Development, Sports Fitness and Recreation and the Arts.

Contact person for youth programs:

Ta-Tiana Anderson-Hall (tandersonhall@bgctm.org) – 2680 E. Ninth St., Reno, NV 89512, 775-331-KIDS

Facebook: www.facebook.com/PositivePlace

Website: www.bgctm.org

Reno Housing Authority

How does RHA support financial wellness within its programs?

RHA offers one-on-one financial coaching to participants living in our Public Housing and Housing Choice Voucher programs. Agency staff is trained to refer participants to our Workforce Development team if they are struggling paying bills, paying rent on time, or if they express any financial literacy needs. Our Workforce Development team will help participants create budgets and provide financial education based on each person’s individual needs.

How does RHA partner with OA-NV to support the financial wellbeing of its clients?

RHA’s Workforce Development team has been trained by OA-NV to be financial coaches. In addition, we are exploring additional partnerships to offer financial literacy workshops to our participants in order to capture larger audiences.

Why does RHA feel its clients’ financial wellbeing is important?

Breaking the cycle of poverty starts with educating and empowering our program participants to take control of their financial foundation. Many of our participants have not had the opportunity to learn how to manage their finances based on their income and needs. RHA aims to increase their knowledge and show them they can be independent of government assistance.

How does financial coaching support the goals of your organization?

Financial coaching is the key to successfully helping our program participants. We use the financial coaching model to assist our participants one-on-one and it enables us to customize a plan for each individual person.

Contact Info

Annette Williams, Workforce Development Coordinator 775.329.3630 ext. 243 & Lisa O’Brien, Workforce Development Coordinator 775-329-3630 ext. 263

Note: Program is only offered to RHA residents who are currently receiving housing assistance.

Website: www.renoha.org

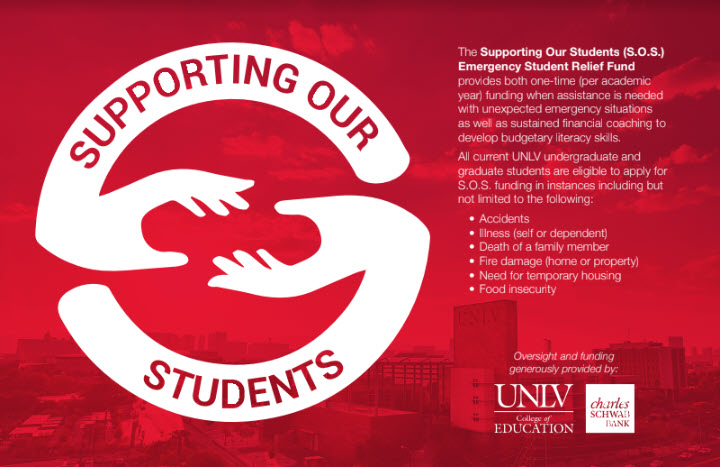

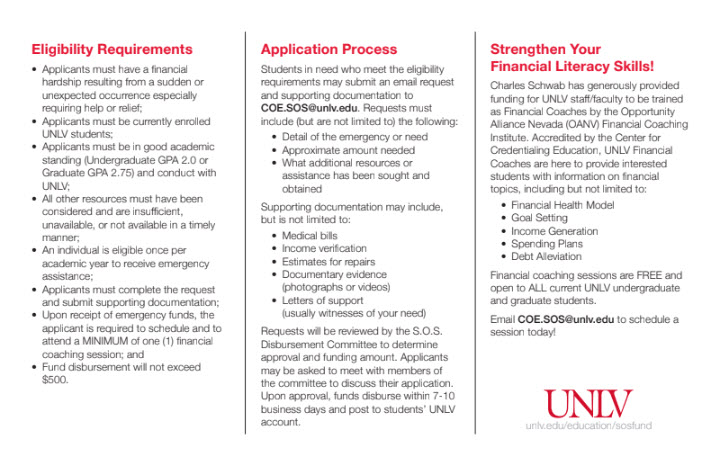

UNLV S.O.S.

University of Nevada, Las Vegas (UNLV) Supporting Our Students (S.O.S.) Emergency Student Relief Fund

How does your organization utilize coaching in their work? Is it with individuals or in a group setting?

Financial Coaching is an essential parto of the SOS Emergency program. Our philosophy is that it is one element to provide aid, and the next step is to provide students with skills and knowledge that may assist them in acquiring better overall financial health. We started with individual sessions only and will begin to offer group sessions starting fall 2019.

What are the goals of your organization?

Primarily to assist students in an emergency to ideally lessen or eliminate the likelihood they may need to “stop out” of school. Financial insecurity has become one of the top reasons students “drop out/stop out” of school. This impacts their overall progression and subsequent completion. In addition, the SOS program seeks to provide students with the opportunity to augment current knowledge regarding financial health.

How does coaching support the goals of your organization?

If a student is awarded SOS funds, a requirement is they must schedule and attend one financial coaching session. Beginning fall 2019, students will be able to register for financial coaching without having received funds.

What is one success story you would like to share?

This was shared by one of our SOS coaches, Kelle Snow. What I consider to be one of the great successes we’ve had so far with Financial Coaching is the connections we’ve been able to make with students. Several of us coaches have had students who have come in for second and even third coaching sessions.

For me in particular, there is one young lady who I’ve been able to form a relationship with over the past few months that I really value. She has spent hours in my office asking questions, talking through new ideas and engaging so deeply in the finance curriculum. Meeting with her is such a joy for me because she is intensely curious and engaged. Plus I can see how the financial coaching is impacting her life. We jump down rabbit hole after rabbit hole together as she realizes that financial literacy has ramifications for all facets of her future. She has made a budget, figured out why her late father made her get a credit card, delineated simple and compound interest, set a savings plan for her next vacation to see her family, and even talked about amortization schedules and what it’ll mean for her in the future when she buys a house. I look forward to my next session with her in the Fall and all of the questions I’m sure she will ask.

Have you encountered any barriers to your organization using coaching?

We have not… the only thing is we have more demand coming and anticipate need to work with our university staff as well as students. We will move in the direction that is needed!

Click Here to Download Flyer

Website: unlv.edu/education/sosfund

TMCC FLAME$

Truckee Meadows Community College (TMCC) Financial Literacy And Money Education by Students (FLAME$)

What motivated TMCC to create the FLAME$ program?

What motivated TMCC to create the FLAME$ program?

The FLAME$ program was created in 2013, thanks for a grant awarded by USA Funds. It was formed for two reasons, the first being to help students develop and enhance their money management skills to assist them in making healthy financial decisions while in college, and also to be able to take charge of their financial life after graduation.

The second reason FLAME$ was formed is to educate students regarding student loans. At the time FLAME$ was created, TMCC had a high student loan default rate of 25.3%. The FLAME$ has worked hard to lower that rate to 14.3% using loan counseling workshops, and one-on-one sessions to educate students on smart loan borrowing.

How does TMCC choose which students will be student mentors?

The FLAME$ peer mentors first go through the interview process just like any student employee at TMCC. They fill out an application using TMCC’s student job board. The application and resume are reviewed by Shari Mathiesen, NSHE Specialist II for Financial Literacy; Valerie Lambert, TMCC Student Employment Coordinator; and the Administrative Assistant II for Financial aid.

The qualifications include:

- A current TMCC Student enrolled in at least 6 credits

- Have a minimum GPA of 2.0

- Minimum of one semester completed at TMCC prior to employment

- Be in good academic standing

- Have a commitment to educating your peers

- Excellent interpersonal skills

- Good listening and verbal communication skills

- Ability to work independently and as a team member

If the student meets these qualifications then the student is interviewed. If selected for the position, the student then is hired and begins both financial aid and financial literacy training.

How does TMCC train their student mentors on financial literacy?

When hired, the student mentor first goes through financial aid basic training, such as learning how to assist students with filling out the FAFSA (Free Application for Federal Student Aid). The financial aid training also includes helping students through the entire FAFSA process, including financial aid verification, financial aid appeals, scholarships, and student loans. The training is quite rigorous and takes approximately 30 days. They then shadow other student employees or staff members helping students at the financial aid front counter and answering the phones.

After learning the financial aid side of it, they are then trained in financial literacy, or what we call FLAME$ which takes about 3 weeks. The FLAME$ training begins with learning basic financial literacy topics such as budgeting and saving, banking, paying off debt, and credit reports and scores. We use the CFPB’s (Consumer Financial Protection Bureau) Your Money Your Goals program as well as the Financial Empowerment toolkit. The peer mentors shadow other team members and learn all of the workshops presentations given by FLAME$. They use role playing to mentor one another guided by myself. The new mentors also practice all of the workshop presentations for the rest of the team and receive feedback on strengths and weaknesses.

What is the most important lesson that FLAME$ would like all TMCC students to know?

FLAME$ would like students to know that no matter where you are in your financial journey there are always various tools you can use to improve their financial situation. Being financially literate is an important component in everyday life. It’s never to early to start and it will make a big difference in your life.

Website: TMCC.edu/FLAMES

Nevada Business Opportunity Fund Nevada Women’s Business Center & Nevada Business Opportunity Fund

Nevada Women’s Business Center & Nevada Business Opportunity Fund

Our mission is to enhance the economic self-sufficiency and quality of life of low and moderate-income individuals through entrepreneurial training, technical assistance, and access to loans for new and expanding businesses throughout Nevada.

The Nevada Women’s Business Center (NWBC) is a federally funded nonprofit organization that is affiliated with the Small Business Administration (SBA). As a community resource for entrepreneur development, we partner with a variety of partners to enhance the growth of Small businesses in Nevada.

The Nevada Women’s Business Center (NWBC) is a federally funded nonprofit organization that is affiliated with the Small Business Administration (SBA). As a community resource for entrepreneur development, we partner with a variety of partners to enhance the growth of Small businesses in Nevada.

Our client demographics consist of:

- Female Clients: 74%

- Male Clients: 26%

- Minority Clients: 63%

- Low-Moderate Income Clients: 31.7%

- Assisted Women-owned Businesses: Over 900

Awards and Achievements

- Urban Chamber of Commerce Business Advocate Award 2019

- National Association of Women Business Owners (NAWBO) Woman of Distinction Award in Business 2018

- Small Business Administration 2017 Rising Star Award

- Small Business Administration 2016 Women’s Business Advocate of the Year

Website: www.nevadabof.org

Northern Nevada Hopes

Northern Nevada HOPES is a nonprofit community health center in downtown Reno, NV that offers integrated medical care and wellness services. We welcome patients, wherever they are in life, and provide them with compassionate, high-quality healthcare. For medically underserved populations, our team-based approach to care gives patients access to a range of comprehensive services, while our one-stop-shop healthcare model reduces barriers to care and increases the likelihood of maintaining long-term health. We believe that addressing health involves more than medical care, which is why we also address social determinants of health. Among these determinants is the relationship between financial well-being and positive health outcomes, which are undeniably linked. In 2017, HOPES launched the Healthy Money Habits (HMH) program that aims to level the playing field for our patient population. It helps patients reach financial wellness by providing financial education, financial coaching, and additional services that help them set and achieve financial goals. The program is available to Northern Nevada HOPES patients and is free of charge. We are not financial advisors or financial counselors, but we are dedicated to improving our patients’ financial health, empowering our community, improving financial literacy, and decreasing stress due to financial issues. Financial health is part of overall health!

Northern Nevada HOPES is a nonprofit community health center in downtown Reno, NV that offers integrated medical care and wellness services. We welcome patients, wherever they are in life, and provide them with compassionate, high-quality healthcare. For medically underserved populations, our team-based approach to care gives patients access to a range of comprehensive services, while our one-stop-shop healthcare model reduces barriers to care and increases the likelihood of maintaining long-term health. We believe that addressing health involves more than medical care, which is why we also address social determinants of health. Among these determinants is the relationship between financial well-being and positive health outcomes, which are undeniably linked. In 2017, HOPES launched the Healthy Money Habits (HMH) program that aims to level the playing field for our patient population. It helps patients reach financial wellness by providing financial education, financial coaching, and additional services that help them set and achieve financial goals. The program is available to Northern Nevada HOPES patients and is free of charge. We are not financial advisors or financial counselors, but we are dedicated to improving our patients’ financial health, empowering our community, improving financial literacy, and decreasing stress due to financial issues. Financial health is part of overall health!

Click Here for Interview with Lillian E. Wilbert, MPH from Northern Nevada HOPES

Website: nnhopes.org

University of Nevada, Reno – Nevada Money Matters

Click Here for Fall 2019 Newsletter

United Way of Northern Nevada and the Sierra

Since 1942, United Way of Northern Nevada and the Sierra (UWNNS) has invested in our 13-county region by bringing people together to give, advocate, and volunteer. Our mission is to link the community’s will and resources to improve lives. UWNNS believes that when the community comes together and puts our resources to work, we can solve our most pressing issues and create opportunities for a better life for all.

UWNNS’s signature focus is improving early literacy and making sure children develop strong reading skills needed for lifelong learning and success.

Website: uwnns.org